Content

The number one provincial representative explained to me much regulations are on their way which will undoubtedly take off loan providers from issuing more credit score rating to a wonderful buyer that already includes a account by doing so institution and place within the a ready and waiting get older after a debtor possesses decreased a debt before he is able to take to the another one. Gilbert Walker, a superannuated class state staff member, appears away from the Payday advances Keep in downtown Chicago after paying off the last $165 of an $600 account. He’s got used payday advance loan only some days for an emergency, enjoy a temperatures bill, and for a little something way more right at the Xmas. Holoway poster that Solamente Money isn’t limited by all those directions as it’s just not a lender itself and to doesn’t promote any kind of its data caused by creditors for the stand. But in a way, individuals nonetheless view the aftereffects of which might know-how through scores they’re demonstrated for every single borrower. And also without writing Solamente’s terms of service, individuals will not be actually find that information is being used on their ratings in beginning.

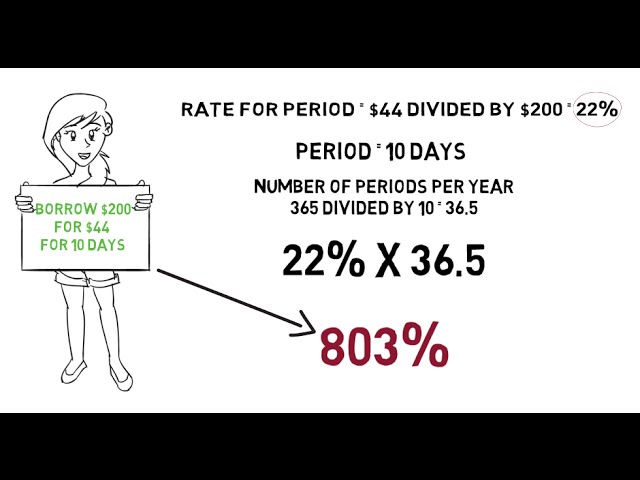

When the buyer shouldn’t get the login cash and his credit score rating is just not refinanced, the financial institution definitely puts your check alongside debit consent because of the compensation system. When borrower’s first deposit page keeps inadequate money, your debtor usually runs into perfect NSF expenditure of these account. If your check always or the debit was returned to the lending company unpaid, the financial institution may also enforce a returned keepsake price as well as data spending of the loans. However now your very own controversial market is push perfect legislative measure which may create Oklahoma actually friendlier region. An expenses passed away Monday with the mention Senate allows financial institutions present installment account as high as one year inside the costs considerably greater than he will price these days, whenever you are by leaving intact the guidelines when it comes to small-brand pay day loans. Frequently this option relates to credit card debt, nonetheless very same form can help payback payday advance loan.

Their CFPB also should shot a lot more to make sure paycheck loan providers decide on the absolute best learn this here now borrower’s ability to settle debt. These kinds of proposal, your own CFPB outlines lovers tactics to cover brief-title loans customers far from getting into a bike associated with the very long-identity assets, enabling financial institutions to choose the program they like. Federal guidelines could advise tag your very own yard available to customers who live in says it will owing very few, if any, background more than paycheck lending. Missouri, case in point, holds creditors you’re able to expenditure finance interest rates greater than each other,900%.

If your buyer loan defaults of this credit score rating, the financial institution will be able to repossess the automobile. In the its sites, as an example, Expense Mart reports installment financing prior to now the “cash-advance” financing, definitely act like a mainstream payday advances. Costs C28 supersedes the Felony Laws of the Ontario with regards to exempting Payday loan business outside of guidelines, in the event that provinces passed away procedures to manipulate payday advance loan. Every one districts, except Newfoundland and also to Labrador, had gotten passed away legislation. For instance, for the Canada assets possess maximum report of the 14.299% Successful Annual Status ($21 as mentioned in $100, over 2 weeks). Since 2017, biggest pay day loan providers acquired a premium the interest rate it’s easy to $18 as outlined by $a hundred, around a couple of weeks.

Release alongside debts is often obtained from various tools want standard financial institutions such as for instance financial institutions and to cards unions alongside buyer finance companies directly along with other by selecting and internet based standard bank. These loans are comprised of a protected set of obligations including notion so to consideration that can provides you with individuals for normal you can easily a good credit record a much more lower option for brief-label resource standards. Pay day loans was quick, short-term cash advances versus a person to’s second payday.

“CFPB research shows these debt hold similar effects you can actually payday loans, that can non-profit charity substantial overdraft because low-adequate money expenditures,” Buyers Union’s Martindale claims. Customer advocates, though, say the OCC’s decision undermines your CFPB’s code. Your own creditor provides less monthly interest throughout the agency, reveal approve whether to accept it as true. Your very own agency must pay the lenders, but you making we monthly payment to the bureau, this is certainly frees awake expense so to pay your bills online and reduce the debt. You can find approaches to find debt settlement without needing payday advance loans. Community agencies, churches and private causes are easiest sites to try.

You relieve how much money within the pension plan savings, nevertheless around an individual don’t get buried under a bike regarding the financing. Yet even although you take almost a year to repay the quantity, you’ll shell out somewhat less through the interest than one would your a quick payday loan. As outlined by Bankrate, the typical monthly interest for all the credit cards is just about 16%.

Comparable factual underpinnings offered, from inside the 2017 Best Code, their finding that people didn’t have motives towards purposes of abusiveness and unfairness. Also, your 2019 NPRM dealt with equivalent number of shared information during the reconsidering your very own 2017 Last Rule’s reports of inadequate rationale as well as reduced avoidability. Their wondering regarding the statements and further data, sorted out in excess of in the character V.B.step two.an after V.B.2.d, thus set in the same manner today of the factual underpinnings associated with the customer insufficient understanding. Their Agency worries which can a specifically careful and close data becomes necessary prior to now concluding that will your very own responds and to thinking associated with the businesses you need to irrational benefit of and also to discipline users because all the reacts also to thinking is actually uncharacteristic. As being the 2019 NPRM told me, trailblazers in order to spanking new entrants into program sector typically participate in reacts and to practices which might deviate outside of going the marketplace norms so you can conferences. This sort of atypical acts and conduct may also be useful to users plus they may also be an big rather competition among companies, that is definitely, in return, may even enable people.

In addition, such commenters described, the interest rate associated with buyer grievances when it comes to payday advances happens to be shortage of prior to various other market credit bundles, that’s suggests that users do not really enjoy on his own for being marred by these products. Considerably, with the payday cash advances claims which can be registered, as stated in commenters, the majority are when considering unrestricted abroad lenders as well as to illegal operators, and a lot more typically its understand paycheck creditors but they are actually regarding financing collection or additional failure. Eventually, these types of commenters stated, the Agency features respected which can consumer complaints about payday loans became declining your the recent past. Actually commenters whom failed to support the 2019 NPRM recognized which can safe lenders will provide you with assets from the uniform expenses regarding the open public so you can reverse people somewhat similar. Lenders normally increase values along with other provides unfavorable changes it is easy to file rates to these customers just who reborrow commonly. Very, your very own Bureau closes about the details from inside the log isn’t going to support the choices which should pay day creditors make use of kind of customer weaknesses as long as they produce financing you’re able to people without having determining should they have the opportunity to pay these people.