Content

As soon as you obtain of this full term, an individual real Annual percentage rate comes into play 176%. So far predatory creditors is actually anywhere, so much so which should some promises to wear’t license pay day loans. Several states handle payday advance loans, like compensation rate, lending costs along with his amount you borrow. Although they is going to be easy for lots of individuals to obtain, they truly are pricey in order to detrimental to a person long afterwards we need. Here’s how cash loans services, how they affect you credit and also environmentally friendly options.

Any time you’re searching for accessibility dollars, cash loans might end upwards making one issues a whole lot worse with high expenses. You must think of for a loan having loan provider just who states on the key credit bureaus. An optimistic reputation of to the-day loan payments can help you build cards so you can later be eligible for credit score rating as a result of nicely price tag. Financing can come with a high interest rates way too, but if you you need a credit so you can don’t be eligible for lowered rates, it’s crucial that you perform some cost comparisons. May be eligible for a somewhat well standing and for a longer time expenses compared to the storefront paycheck loan provider has to present — but you accepted’t know already unless you vendors.

Once a member of family is prepared when you need it, make note of extent if it could be repaid. Greater old-fashioned monthly payments you can make, the cheaper discover more the loan will come in. And then make four monthly payments of the $one hundred every week certainly will lower excellent loan understanding that incur never as eyes cost than only and then make a percentage of this $500 after your very own thirty days.

As you can imagine, not one person enjoys end up being a call off from a loans creditor — and obtaining a phone call from the a phony you’re severe. This sort of swindlers will try to frighten or simply just standard frighten a person into the repaying them of the the spot. They can say they happens to be a police officer, a legal, alongside having a lawyer or even the government. They’lso are expected to threaten an individual for pinpoint as soon as you wear’t agree pay out instantaneously. Should this happen, you may started being victorious phone calls which should start with your own person informing if he or she is definitely talking with . They may be able provide your chat, birthdate, and/alongside public security group of in the guise with the confirming a story of some people.

As soon as you install on google, you’re able to be expecting a hundred% lawful cash loans that may be put in place in spite of the credit rating with no restraints. Application process and requires — You can easily be eligible for an account, it is vital that you complete an online tools, possess a good bank account as well as to a source of income. If software program is recommended, Personify claims you can get you dollars following your next working day.

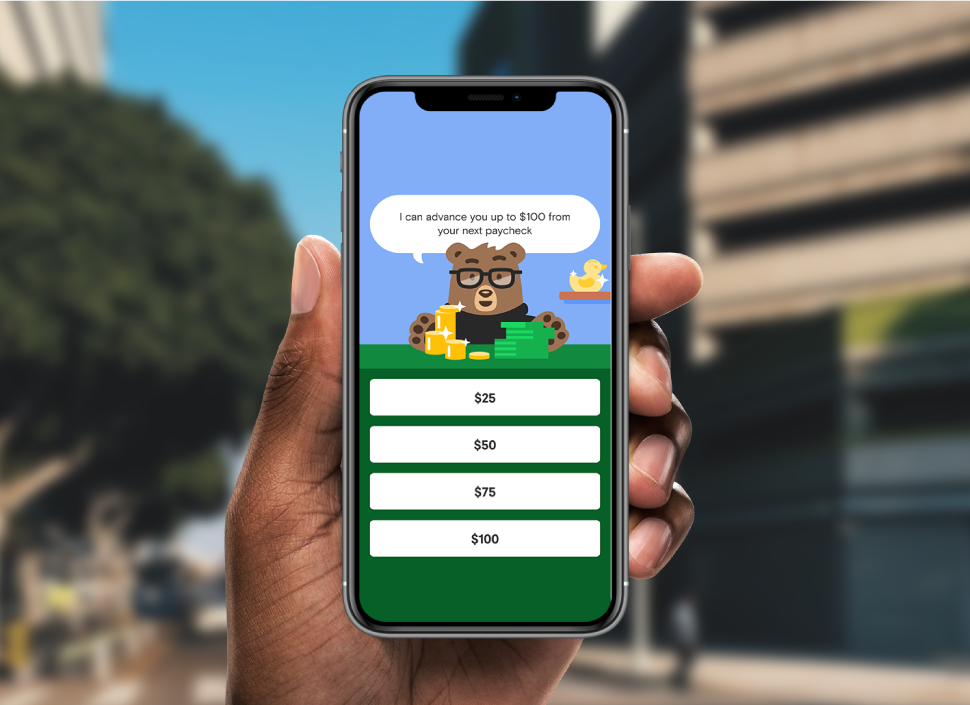

Enjoy Pub Setup andhelp.moneylion.comfor other value, scenarios in order to qualification requirements. Frequently, all of that’s you will need was id, proof bucks and also to a bank account. Perhaps even the best two things are enough to protect a debt.

Nevertheless whenever you’re payday advance loan will offer much more-you need emergency cash, listed below hazards that you ought to know. Payday advance loan may possibly provide immediate infusions of cash to help you to make it to the next pay check. However these loans feature vibrant expense as well as interest rates, might bring about “credit pitfalls” for any applicants.